In order to increase the volume of profit, it is the primary aim of all business enterprises to increase their volume of sales. For this purpose, many firms open their shops in different parts of the locality/country. (The parent establishment is known as ‘Head Office’ and its offshoots are termed as ‘Branch’.)

Besides, if branches are opened, particularly in developed regions, both the local consumers and the firms are benefited.

Practically, it is an extension of an existing firm. It should be remembered that a branch has its separate existence but does not possess any separate legal entity. That is why, it is said that it is nearly an extension and a profit centre of an existing firm. Needless to say that all activities of the branches are controlled by the Head Office.

According to Sec. 2 (a) of the Companies Act, 1958, a branch (office) is defined as:

(a) Any establishment described as a branch by the Company, or,

(b) Any establishment carrying on either the same or substantially the same activity as that carried on by the head office of the company, or

(c) Any establishment engaged in any production, processing or manufacture, but does not include any establishment specified in any order made by the Central Govt., u/s-8.

Similarly according to Sec. 8, the Central Govt., may, by order, declare that in the case of any company any establishment carrying on either the same or substantially the same activity as that carried on by the Head Office of the Company, or any establishment engaged in any production, Passing or manufacture shall not be treated as a branch office of the company for all or any of the purposes of the Act.

It has already been stated above that a branch is an extension and a profit centre of the Head Office. Consequently profit of the branch is to be ascertained periodically by the Head Officer this purpose proper accounting should be maintained both in the books of branch as well as in the books of Head Office.

As the activities of branches vary from branch to branch, system of branch accounting depends on their nature, type, size, locality i.e., area of operation etc.

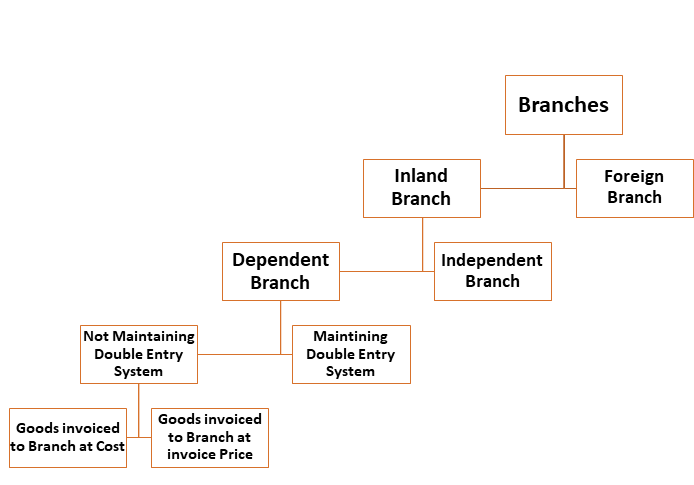

Types of Branches:

There are different types of branches according to their nature and magnitude of operation, although all the branches are operated under the instruction of Head Office. As a result, the system of branch accounting is not the same in all the cases.

However, branches may be classified as:

1. Inland Branch (also known as Domestic Branch or Home Branch)

1. Inland Branch (also known as Domestic Branch or Home Branch)

These branches are situated within the territory of the country. These branches do not maintain accounts under Double Entry System. They simply read out periodical statements to Head Office relating to goods received, goods sold, amounts returned, expenses, stock position (both at the beginning and at the end.)

These branches are not allowed to purchase goods from outside market. As all collections are directly remitted to Head Office, naturally, expenses of branches are met by Head Office. In other words, these branches are operated and controlled by Head Office.

- Dependent Branch

Dependent branches are those which do not maintain separate books of account and wholly depend on Head Office. The result of the operation, i.e., profit or loss, is ascertained by Head Office. In other words Head Office maintains and opens a Branch Account in its book in order to find out the result of the operation. Branches supply some related information to the Head Office, i.e., position of cash, debtors stocks, etc.

- Independent Branch

Independent branches are those which maintain complete system of accounting. This particularly happens when their sizes are very large due to various functional complexities. In short, they prepare their accounts independently, i.e., they also purchase and sell goods for cash and credit independently in addition to the goods that are supplied by the Head Office.

They may supply goods to Head Office, pay expenses and deposit cash in their own account like an independent unit. Thus, they maintain their own accounts under Double Account System. That is why they are called Independent Branch.

2. Foreign Branch

These branches are located outside the country. They are operated in the foreign country which has a different currency and, as such, question of rate of exchange will arise. These branches may be of:

(i) Dependent Branch

(ii) Independent Branch depending on the method of accounting.

Branch Accounts

Branch Accounts are maintained by a business to record and manage the financial transactions of its branches, which are geographically separated units or outlets operating under the control of a head office. The objective is to assess the performance and financial position of each branch individually and integrate it with the overall business accounts.

Objectives of Branch Accounts:

- To Ascertain Branch-wise Profit or Loss

The primary objective of branch accounts is to determine the individual profitability of each branch. This helps the head office evaluate how each branch contributes to the overall profit or loss of the business. By maintaining separate accounts for each location, the business can identify which branches are performing well and which need improvement. This clarity supports targeted decision-making, such as expanding profitable branches or addressing operational issues in underperforming ones.

- To Exercise Effective Control Over Branch Operations

Branch accounts allow the head office to monitor and control branch activities. Since branches are physically separate, central oversight ensures that operations are consistent with company policies. Regular reporting of accounts, sales, stock, and expenses enables management to keep track of branch behavior, prevent mismanagement, and maintain financial discipline. This control is especially crucial in ensuring proper cash handling and compliance with internal systems.

- To Ensure Accurate Recording of Transactions

Maintaining branch accounts ensures that all branch-related transactions are systematically recorded and tracked. It provides a detailed view of the flow of goods, cash, receivables, and payables at each branch. This accuracy in recording helps in the proper allocation of resources, facilitates audit trails, and reduces the chance of errors or fraud. Accurate records form the foundation for preparing reliable consolidated accounts for the entire business.

- To Assess the Financial Position of Each Branch

Branch accounting aims to assess the financial position of each branch separately. By maintaining a distinct account for each unit, the business can evaluate assets, liabilities, and capital employed at every branch. This helps in determining working capital needs, investment decisions, and branch-specific performance. It enables the head office to make informed decisions based on real-time financial data of individual branches.

- To Evaluate Operational Efficiency

By analyzing branch accounts, a company can evaluate how efficiently a branch operates in terms of cost management, resource utilization, and sales generation. It helps management understand if a branch is over-spending or under-performing. This evaluation assists in making operational changes like staffing adjustments, pricing strategies, or marketing efforts specific to a branch, thereby improving overall efficiency and profitability.

- To Facilitate Comparison Between Branches

Another key objective of branch accounts is to enable inter-branch comparisons. When the head office maintains records for all branches in a uniform format, it can easily compare their performance. These comparisons help in identifying best practices, recognizing top-performing branches, and applying lessons learned across the organization. They also foster a healthy competitive environment among branches, motivating better performance.

- To Help in Consolidation of Financial Statements

Branch accounts are essential for the preparation of consolidated financial statements. The head office combines data from all branches to create an accurate picture of the company’s financial health. Properly maintained branch accounts make this consolidation process smooth and ensure that all transactions, including inter-branch transfers, are correctly accounted for. This is especially critical for companies with national or international operations.

- To Detect and Prevent Frauds or Irregularities

Maintaining systematic branch accounts serves as a tool for detecting irregularities such as theft, misappropriation, or unauthorized expenses. Regular review and reconciliation of branch records with head office reports allow for timely identification of discrepancies. This objective strengthens internal control systems and discourages fraudulent practices at the branch level. It also enhances transparency and accountability across the organization.

Advantages of Branch Accounts:

- Determines Branch-wise Profit or Loss

Branch accounts help a business ascertain the individual profit or loss made by each branch. This enables the head office to assess which branches are financially viable and which ones need improvement. By knowing the exact profitability, businesses can make informed decisions about expanding, closing, or restructuring branches. It also helps in evaluating branch managers’ performance and aligning resources where returns are optimal, thus improving overall organizational efficiency.

- Facilitates Better Control and Supervision

Maintaining separate accounts for each branch allows the head office to exercise control over operations. It becomes easier to monitor expenses, revenues, stock, and cash movements. Timely reports from branches help detect irregularities or inefficiencies, allowing corrective action. This continuous oversight strengthens internal control and accountability across branches. It also reduces the chances of fraud or misuse of funds, ensuring that each branch operates in accordance with company policies and procedures.

- Enables Inter-Branch Comparison

Branch accounts enable businesses to compare performance across branches. With access to financial data from each branch, the company can analyze which ones perform better in terms of sales, cost-efficiency, or customer satisfaction. This comparison promotes healthy competition among branches and helps identify best practices that can be replicated elsewhere. It also allows management to address performance gaps and motivate employees through branch-specific targets and incentives.

- Aids in Budgeting and Planning

Branch accounting supports effective budgeting and financial planning. Since it provides detailed data on income and expenses at each branch level, management can allocate budgets more accurately. It also assists in forecasting revenue, estimating costs, and planning future investments or expansions. Having clear financial insights branch-wise enables informed decision-making, helping the business avoid underfunding or over-expenditure and enhancing the efficiency of resource utilization.

- Helps in Consolidation of Accounts

Proper branch accounting simplifies the preparation of consolidated financial statements. The head office can easily merge all branch accounts into the main accounts without confusion or errors. It ensures that all inter-branch transactions are reconciled, and duplications are avoided. This leads to accurate representation of the company’s overall financial position, which is crucial for external reporting, audits, and decision-making by stakeholders like investors and financial institutions.

- Strengthens Internal Control

Branch accounts enhance the internal control mechanisms of a business. By recording transactions and maintaining financial discipline at the branch level, companies reduce the risk of theft, fraud, or accounting errors. Regular review and reconciliation of accounts ensure transparency and integrity in operations. It promotes responsible behavior among branch staff and creates an organized system that is easier to audit and manage from the central office.

- Supports Performance Evaluation

Branch accounts are an effective tool for evaluating the performance of branches and staff. They provide measurable financial data such as profits, expenses, and sales figures, which can be used to appraise branch managers and employees. This leads to a fair reward system, improved accountability, and motivation to meet or exceed performance targets. It also identifies training or support needs, enabling continuous improvement in branch operations.

- Aids in Decision Making

Accurate and timely branch accounts offer valuable data for strategic business decisions. Whether it’s opening a new branch, discontinuing an unprofitable one, or modifying pricing and product strategies, such decisions rely on reliable branch-level financial information. These insights help businesses adapt to local market conditions, manage risks, and take advantage of new opportunities, ensuring sustainable growth and profitability across different locations.

Disadvantages of Branch Accounts:

- Increases Administrative Burden

Maintaining branch accounts requires extensive administrative effort, especially for businesses with multiple branches. Each branch needs to submit periodic reports, reconcile inter-branch transactions, and follow standardized accounting procedures. This increases the workload of the head office and demands additional staff, time, and infrastructure. Managing these processes centrally can be challenging, particularly when branches are geographically distant or operate under varied conditions, making coordination complex and potentially inefficient.

- High Cost of Maintenance

Branch accounting can result in increased operational costs. The system demands additional personnel, accounting software, training, and resources to maintain accurate branch records. For smaller organizations or businesses with limited margins, the cost of setting up and running a separate accounting system for each branch may outweigh the benefits. These added expenses can impact overall profitability, especially if branches are small or still in the growth stage.

- Possibility of Errors and Omissions

Due to the involvement of multiple branches and personnel, the chances of errors, omissions, or duplication of entries increase. Improper recording of transactions, incorrect communication of figures, or delays in sending reports to the head office can lead to inconsistencies in records. This may result in inaccurate financial statements, difficulties during audits, and misleading performance evaluation, thereby affecting decision-making and financial integrity.

- Complex Inter-Branch Reconciliation

Inter-branch transactions, such as transfers of goods, funds, or services, require careful documentation and reconciliation. This process can become time-consuming and complicated, especially when branches do not follow uniform practices or when errors are made during reporting. Discrepancies may arise, leading to delays in preparing final accounts or even causing confusion in overall business performance. Consistent reconciliation becomes a challenge for larger organizations with many branches.

- Delay in Data Reporting and Analysis

Branches may not always be prompt or efficient in submitting their financial data to the head office, resulting in delays in analysis and reporting. If reports are incomplete, late, or inaccurate, it becomes difficult to make timely and informed decisions. This lag can affect strategic planning, budgeting, and overall control of the organization. In fast-paced markets, delays in data flow can mean missed opportunities or avoidable losses.

- Dependency on Branch Staff Efficiency

The quality of branch accounts is heavily dependent on the efficiency, honesty, and competence of branch staff. Lack of proper training or negligence can result in poor bookkeeping, misreporting, or even fraud. If branch employees are not well-versed in accounting practices, it affects the accuracy of records, leading to complications during audits and performance reviews. This adds to the supervisory load on the head office.

- Inconsistency in Accounting Practices

Different branches may follow inconsistent accounting procedures, especially if operations are spread across regions with varying local practices or if systems are not well standardized. This inconsistency can lead to inaccurate comparisons between branches and affect the reliability of consolidated financial statements. It also increases the complexity of auditing and financial analysis, and may require additional adjustments to achieve standardization during consolidation.

- Limited Real-Time Access to Data

In many traditional branch accounting systems, data is collected periodically (monthly, quarterly) and sent to the head office. This means that management may not have real-time visibility into branch performance. In today’s dynamic business environment, the lack of immediate data can hinder quick decision-making and response to market changes. Unless an integrated digital system is used, this delay reduces the effectiveness of branch monitoring and control.

One thought on “Branch Accounts”