EMI stands for Equated Monthly Installment, a fixed payment amount made by a borrower to a lender at a specified date each calendar month. EMIs are used to pay off both interest and principal each month so that over a specified number of years, the loan is paid off in full. With a stable, predictable repayment schedule, EMIs help borrowers budget their monthly household expenses effectively. The EMI amount is dependent on three key factors: the loan amount, the interest rate charged by the lender, and the tenure of the loan. The interest component of the EMI is larger during the initial months and gradually reduces with each payment. The exact proportion allocated towards repayment of the principal depends on the interest rate. Even though EMIs can make expensive purchases seem affordable, it’s crucial for borrowers to consider their repayment capacity before taking on a loan to avoid financial strain.

EMI Calculations:

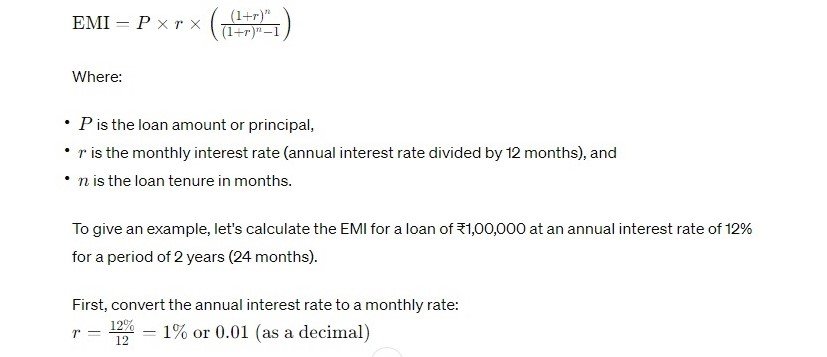

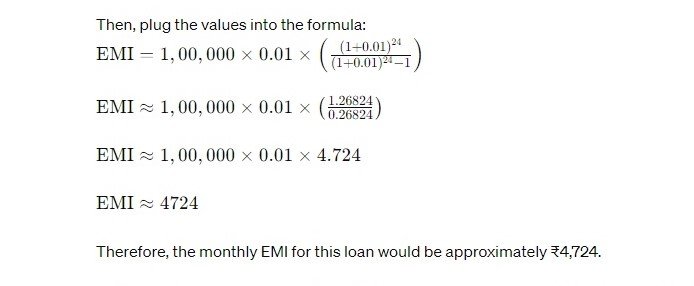

EMI (Equated Monthly Installment) calculations are crucial for understanding how much you will need to pay monthly for a loan. The calculation takes into account the principal loan amount, the interest rate, and the tenure of the loan. The formula to calculate EMI is:

EMI Long term Impact:

-

Interest Payment Over Time

One of the most significant long-term impacts of choosing an EMI payment option is the total interest paid over the life of the loan. For long-term loans, such as home mortgages that can extend up to 30 years, the total interest paid can sometimes exceed the principal borrowed. This means the longer the tenure of your loan, the more you end up paying in interest.

-

Effect on Savings and Investment

Monthly EMI payments can also impact an individual’s ability to save and invest. A significant portion of your income might be dedicated to EMI payments, leaving less available for savings or investments that could yield returns in the future. This opportunity cost should be considered when deciding to take on long-term debt.

-

Credit Score and Borrowing Capacity

Regular EMI payments can positively affect your credit score, provided payments are made on time. This can enhance your borrowing capacity in the future. However, missing EMI payments can hurt your credit score, making it harder or more expensive to borrow money later. Additionally, taking on too much debt can lead to a high debt-to-income ratio, which negatively impacts your credit score and future loan eligibility.

-

Financial Flexibility

Long-term EMI commitments can reduce financial flexibility. Life circumstances change, and being locked into significant monthly payments can make it challenging to adapt financially to new situations, such as a job loss, medical emergency, or other unforeseen expenses. This lack of flexibility needs to be weighed against the immediate need or desire that the loan fulfills.

-

Asset Ownership and Value

In the case of mortgages or auto loans, the asset purchased serves as collateral for the loan. While this eventually leads to asset ownership, depreciation or changes in market value can affect the asset’s worth over time. For instance, real estate may appreciate, offering a potential return on investment. Conversely, vehicles typically depreciate quickly, meaning the loan’s interest might lead to paying significantly more than the asset’s value over time.

-

Psychological Impact

The obligation of long-term EMIs can also carry a psychological impact, as it represents a fixed financial commitment. For some, this can lead to stress or financial strain, particularly if their financial situation changes.