Correct final accounts of a business can be prepared in the records are maintained under the double entry system. How every where the record is incomplete, and it is not all possible to complete it by double entry, in such cases the final accounts can be only approximately prepared by means of a statement of affairs. In appearance the statement of affairs is similar to a balance sheet. For this purpose, two comparative statement of affairs are prepared – one at the commencement of the year and other at the end of the year. The excess of the assets over the liabilities as shown by the statement will represent the capital of the firm. If capital at the end shows an increase as compared to the amount of capital at the start the difference will represent profit and if the capital at the end is less than the capital at the beginning the difference will be loss. In this calculation, however, two more factors should be taken into account.

- Where fresh capital has been introduced into the business during the account period, the closing capital may be taken to have been increased to that extent. To arrive at the true profit or loss, therefore, the amount of fresh capital introduced is deducted from the closing assets as determined under such circumstances.

- Where drawings have been made by the proprietor during the accounting period, such drawings reduce the amount of capital at the close. In order to calculate net profit, it is necessary, therefore, that amount withdrawal should be added to the capital at the close before deducting from it the capital at the beginning.

FORMULA:

Formula for determining the net profit is put as follows:

(CAPITAL AT THE END + DRAWINGS – ADDITIONAL CAPITAL INTRODUCED) – CAPITAL IN THE BEGINNING

Example: 1

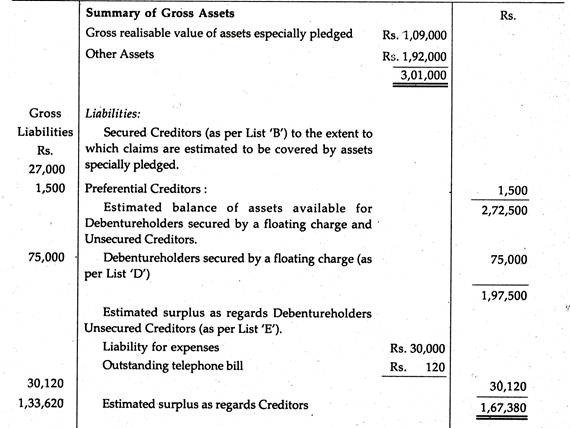

Sri Gobinda Chandra Sadhu khan is appointed liquidator of Sun Co. Ltd in voluntary liquidation on 1st July 1993.

Following balances are extracted from the books on that date:

You are required to prepare a Statement of Affairs to the meeting of Creditors.

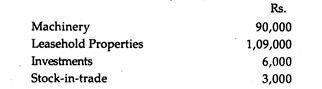

The following assets are valued as:

Bad Debts are Rs. 3,000 and the doubtful debts are Rs. 6,000 which are estimated to realize Rs. 3,000. The Bank Overdraft secured by deposit of title deeds of Leasehold Properties. Preferential Creditors are Rs. 1,500. Telephone rent outstanding is Rs. 120.

Example: 2

Bad Debts are Rs. 3,000 and the doubtful debts are Rs. 6,000 which are estimated to realize Rs. 3,000. The Bank Overdraft secured by deposit of title deeds of Leasehold Properties. Preferential Creditors are Rs. 1,500. Telephone rent outstanding is Rs. 120.

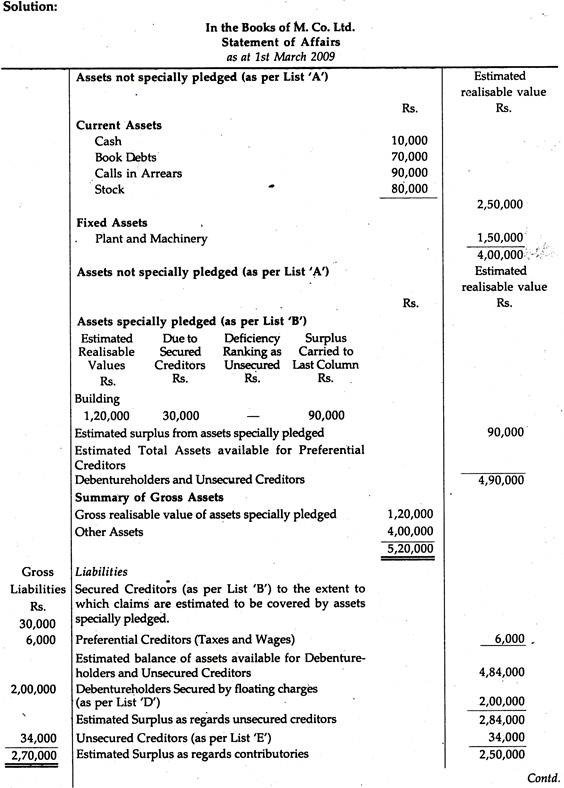

Plant and Machinery and Building are valued at Rs. 1, 50,000, and Rs. 1, 20,000, respectively. On realization, losses of Rs. 15,000 are expected on Stock. Book-Debts will realise Rs. 70,000. Calls-in- arrear are expected to realise 90%. Bank Overdraft is secured against Buildings. Preferential Creditors for taxes and wages are Rs. 6,000 and Miscellaneous Expenses outstanding Rs. 2,000.

Prepare a Statement of Affairs to be submitted to the meeting of creditors.