The Indian money market cannot be considered as an integrated unit. It can be broadly divided into two different parts, i.e., the unorganised and organised segments. There are lot of differences between unorganised and organised segment of Indian money market.

The Money market in India is a correlation for short-term funds with maturity ranging from overnight to one year in India including financial instruments that are deemed to be close substitutes of money. Similar to developed economies the Indian money market is diversified and has evolved through many stages, from the conventional platform of treasury bills and call money to commercial paper, certificates of deposit, repos, forward rate agreements and most recently interest rate swaps

The Indian money market consists of diverse sub-markets, each dealing in a particular type of short-term credit. The money market fulfills the borrowing and investment requirements of providers and users of short-term funds, and balances the demand for and supply of short-term funds by providing an equilibrium mechanism. It also serves as a focal point for the central bank’s intervention in the market.

While the unorganised sector is constituted by money lenders and the indigenous bankers but the organised sector is again constituted by the nationalised and private sector commercial banks, the foreign banks, co-operative banks and the Reserve Bank of India (RBI). The unorganised segment of the Indian money market is not a homogenous and integrated sector but the organised sector of the Indian money market is a fairly integrated one.

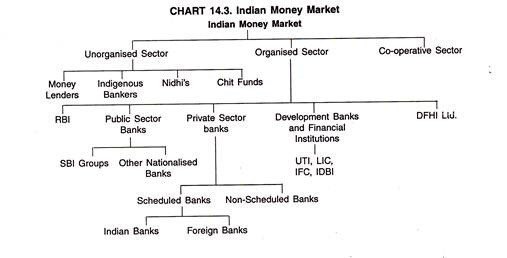

Chart below shows the structure of Indian money market:

Unorganised Sector of Indian Money Market:

Unorganised segment of the Indian money market is composed of unregulated non-bank financial intermediaries, indigenous bankers and money lenders which exist even in the small towns and big cities. Their lending activities are mostly restricted to small towns and villages. The persons who normally borrow from this unorganised sector include farmers, artisans small traders and small scale producers who do not have any access to modern banks.

The following are some of the constituents of unorganised money market in India.

(i) Indigenous Bankers:

Indigenous bankers include those individuals and private firms which are engaged in receiving deposits and giving loans and thereby acting like a mini bank. Their activities are not at all regulated. During the ancient and medieval periods, these indigenous bankers were very active. But with the growth of modern banking, particularly after the advent of British, the business of the indigenous bankers received a setback.

Moreover, with the growth of commercial banks and co-operative banks the area of operations of indigenous bankers has again contracted further. Even today, a few thousands of indigenous bankers are still operating in the western and southern parts of the country and engaging themselves in the traditional banking business.

Indigenous bankers are classified into four main sub groups, i.e., Gujarati Shroffs, Multani-or Shikarpuri Shroffs, Chettiars and Marwari, Kayast. Gujarati Shroffs are mostly operating in Mumbai, Kolkata and in industrial and trading cities of Gujarat. The Multani or Shikarpuri Shroffs are operating mainly in Mumbai and Chennai. The Chettiars are mostly found in the South.

The Marwari Shroffs are mostly active in Mumbai, Kolkata, tea gardens of Assam and also in different other parts of North-East India. Among the four aforesaid groups, the Gujarati indigenous bankers are considered as the most powerful groups in respect of its volume of business.

The indigenous bankers are mostly engaged in both banking and non-banking business which they do not want to separate. Their lending operations remain mostly unregulated and unsupervised. They charge high rate of interest and they are not influenced by bank rate policy of the Reserve Bank of India.

(ii) Unregulated Non-Bank Financial Intermediaries:

There are different types of unregulated non-bank financial intermediaries in India. They are mostly constituted by loan or finance companies, chit funds and ‘nidhis’. A good number of finance companies in India are engaged in collecting substantial amount of funds in the form of deposits, borrowings and other receipts.

They normally give loans to wholesale traders, relailers, artisans, and different self-employed persons at a high rate of interest ranging between 36 to 48 per cent.

There are various types of chit funds in India. They are doing business in almost all the states but the major portion of their business is concentrated in Tamil Nadu and Kerala. Moreover, there are ‘nidhis’ operating in South India which are a kind of mutual benefit funds restricted to its members.

(iii) Moneylenders:

Moneylenders are advancing loans to small borrowers like marginal and small farmers, agricultural labourers, artisans, factory and mine workers, low paid staffs, small traders etc. at very high rates of interest and also adopt various malpractices for manipulating loan records of these poor borrowers.

There are broadly three types of moneylenders:

(i) Professional moneylenders dealing solely with money lending;

(ii) Itinerant moneylenders such as Kabulis and Pathans and

(iii) Non-professional moneylenders.

The area of operation of the moneylenders is very much localised and their methods of operation is also not uniform. The money lending operation of the moneylenders is totally unregulated and unsupervised which leads to worst exploitation of the small borrowers.

Moneylenders have become a necessary evil in the absence of sufficient institutional sources of credit to the poorer sections of society. Although various measures have been introduced to control the activities of moneylenders but due to lack of political will, these are not enforced, leading to a exploitation of small borrowers.

Organised Sector of Indian Money Market:

The organised segments of the Indian money market is composed of the Reserve Bank of India (RBI), the State Bank of India, Commercial banks, Co-operative banks, foreign banks, finance corporations and the Discount or Finance House of India Limited. The segment of Indian money market is quite integrated and well organised.

Mumbai, Kolkata, Chennai, Delhi, Bangalore and Ahmedabad are the leading centres of the organised sectors of the Indian money market. The Mumbai money market is a well organised, having head offices of the RBI and different commercial banks, two leading well developed stock exchanges, the bullion exchange and fairly organised market for Government securities. All these have placed the Mumbai money market at par with New York money market of USA and London money market of England.

The main constituents of the organised sector of Indian money market include:

(i) The Call Money Market,

(ii) The Treasury Bill Market,

(iii) The Commercial Bill Market,

(iv) The Certificates of Deposits Market,

(v) Money Market for Mutual Funds and

(vi) The Commercial Paper Market.

(i) Call Money Market:

The call money market is a most common form of developed money market. It is a most sensitive segment of the financial system which reflects clearly any change in it. The call money market in India is very much centred at Mumbai, Chennai and Kolkata and out of which the Mumbai is the most important one. In such market, lending and borrowing operations are carried out for one day.

The call money market in also termed as inter-bank call money market. Normally, scheduled commercial banks, Cooperative banks and the Discount and Finance House of India (DFHI) operate in this market and in a special situation; the LIC, UTI, the GIC, the IDBI and the NABARD are permitted to operate as lenders in this call money market. In this market, brokers usually play an important role.

(ii) Treasury Bill Market:

Treasury bill markets are markets for treasury bills. In India such treasury bills are short term liability of the Central Government which are of 91 day and 364 day duration. Normally, the treasury bills should be issued so as to meet temporary revenue deficit over expenditure of a Government at some point of time. But, in India, the treasury bills are, nowadays, considered as a permanent source of funds for the Central Government.

In India, the RBI is the major holder of the treasury bills, which is around 90 per cent of the total. In India, ad-hoc treasury bills have now been replaced by ways and means Advances since April 1, 1997, so as to finance temporary deficits of the Central Government.

(iii) Commercial Bill Market:

The Commercial bill market is a kind of sub-market which normally deals with trade bills or the commercial bills. It is a kind of bill which is normally drawn by one merchant firm on the other and they arise out of commercial transactions.

The purpose for issuing a commercial bill is simply to reimburse the seller as and when the buyer delays payment. But, in India, the commercial bill market is not so developed. This is mainly due to popularity of the cash credit system in bank lending and the unwillingness on the part of large buyer to bind himself to payment schedule related to the commercial bill and also the lack of uniform approach in drawing bills.

Commercial bills are an instrument of credit which is very much useful to business firms and banks. In India, the outstanding amount of commercial bills rediscounted by the banks with different financial institutions at the end of March, 1996 was to the extent of only Rs 374 crore.

(iv) Certificate of Deposit (CD) Market:

The certificate of Deposit (CD) was introduced in India by the RBI in March 1989 with the sole objective of widening the range of money market instruments and also to attain higher flexibility in the development of short term surplus funds for the investors. Initially the CDs are issued by scheduled commercial banks in multiples of Rs 25 lakh and also to the extent of a minimum of Rs 1 crore.

Maturity period of CDs varied between three months and one year. In India, six financial institutions, viz., IDBI, ICICI, IFCI, IRBI, SIDBI and Export and Import Bank of India were permitted in 1993 to issue CDs for period varying between 1 to 3 years.

Banks normally pay high rates of interest on CDs. In 1995-96, the stringent conditions in the money market induced the bankers to mobilise a good amount of resources through CDs. Accordingly in recent years, the outstanding amount of CDs issued by the commercial banks has almost been doubled from Rs 8,017 crore in March, 1995 to Rs 16,316 crore as on 29th March, 1996.

(v) Commercial Paper Market:

In India, the Commercial Paper (CP) was introduced in the money market in January 1990. A listed company having working capital not less than Rs 5 crore can issue CP. Again the CP can be issued in multiples of Rs 25 lakhs subject to a minimum of Rs 1 crore for a maturity period varying between three to six months. CPs would be again freely transferable by endorsement and delivery.

(vi) Money Market Mutual Funds:

In India, the RBI has introduced a scheme of Money Market Mutual Funds (MMMFs) in April 1992. The main objective of this scheme was to arrange an additional short term avenue for the individual investors. This scheme has failed to receive much response as the initial guidelines were not attractive. Thus, in November, 1995, the RBI introduced some relaxations in order to make the scheme more attractive and flexible.

As per the existing guidelines, the banks, public financial institutions and the private financial institutions are allowed to set up MMMFs. In the mean time, the limits of investment in individual instruments by MMMF have already been deregulated. Since April 1996, the RBI has allowed MMMFs to issue units to corporate enterprises and others at par with the mutual funds introduced earlier.

As per the latest data available from Association of Mutual Funds, overall, the combined Assets Under Management (AUM) of all the mutual fund houses in country stood at Rs 5,06,692.6 crore. The top five mutual funds of the country include Reliance MF, ICICI Prudential MF, UTI-MF, HDFC MF and Franklin Templeton MF. Reliance MF continued to be the most valued fund house in the country with assets under management (AUM) of Rs 90,937.94 crore at the end of March 31, 2008.

The industry body Assocham Chamber recently conducted a survey on “MF Growth Patterns” and accordingly observed that the Mutual Fund industry has growth 25 per cent between 1999 and 2007 to stand at Rs 4,67,000 crore and the trend would improve as MFs are becoming a preferred choice for both rural and urban retail investors.

The mutual fund sector would grow at compound annual rate of 30 per cent in next three years to become Rs 9,50,000 crore industry as predicted by the survey. The share of privately managed MF players in the total MF industry is expected to fall to 70 per cent from the current estimation of 82 per cent. The reduction would result from the alliance of the private players with overseas partners.

Features

- It is a market purely for short-term funds.

- Money market has no geographical constraints as that of a stock exchange. The financial institutions dealing in monetary assets may be spread over a wide geographical area.

- It relates to all dealings in money or monetary assets.

- Even though there are various centers of money market such as Mumbai, Calcutta, Chennai, etc., they are not separate independent markets but are inter-linked and interrelated.

- It is not a single homogeneous market. There are various sub-markets such as Call money market, Bill market, etc.

- Money market establishes a link between RBI and banks and provides information of monetary policy and management.

- Transactions can be conducted without the help of brokers.

- Variety of instruments are traded in money market.

Importance

Help to Central Bank:

Though the central bank can function and influence the banking system in the absence of a money market, the existence of a developed money market smoothens the functioning and increases the efficiency of the central bank.

Money market helps the central bank in following ways:

(a) The short-run interest rates of the money market serves as an indicator of the monetary and banking conditions in the country and, in this way, guide the central bank to adopt an appropriate banking policy,

(b) The sensitive and integrated money market helps the central bank to secure quick and widespread influence on the sub-markets, and thus achieve effective implementation of its policy.

Self-Sufficiency of Commercial Bank:

Developed money market helps the commercial banks to become self-sufficient. In the situation of emergency, when the commercial banks have scarcity of funds, they need not approach the central bank and borrow at a higher interest rate. On the other hand, they can meet their requirements by recalling their old short-run loans from the money market.

Profitable Investment:

Money market enables the commercial banks to use their excess reserves in profitable investment. The main objective of the commercial banks is to earn income from its reserves as well as maintain liquidity to meet the uncertain cash demand of the depositors. In the money market, the excess reserves of the commercial banks are invested in near-money assets (e.g. short-term bills of exchange) which are highly liquid and can be easily converted into cash. Thus, the commercial banks earn profits without losing liquidity.

Financing Trade:

Money Market plays crucial role in financing both internal as well as international trade. Commercial finance is made available to the traders through bills of exchange, which are discounted by the bill market. The acceptance houses and discount markets help in financing foreign trade.

Financing Industry:

Money market contributes to the growth of industries in two ways:

(a) Money market helps the industries in securing short-term loans to meet their working capital requirements through the system of finance bills, commercial papers, etc.

(b) Industries generally need long-term loans, which are provided in the capital market. However, capital market depends upon the nature of and the conditions in the money market. The short-term interest rates of the money market influence the long-term interest rates of the capital market. Thus, money market indirectly helps the industries through its link with and influence on long-term capital market.

Indian Money Market Reform

Reserve Bank of India is the biggest regulator of the Indian markets. It controls the monetary policy of India. Its control is however limited to the organised part of economy and the unorganised sector which has a significant presence is largely unregulated. RBI frequently introduces many reforms to bolster the Indian economy which is in a state of constant flux and is continuously evolving.

The bill market scheme was one very important step. But the Indian money market is still centred on the call money market although efforts have been made to develop secondary market in post 1991 period.

The major money market reforms came after the recommendations of S. Chakravarty Committee and Narsimham Committee. These were major changes which helped unfold the banking potential of India and shape our financial institutions to world class standards. It was soundness of these reforms which helped our economy to easily tide over the economic crisis which had gripped the world in 2008.

Discount and Finance House of India Ltd:

Has been set up as a part of the package of reforms of the money market. It buys bills and other short term papers from banks and financial institutions. It provides short term investment opportunity to banks.

To develop a secondary market in Government securities, it started buying and selling securities to a limited extent in 1992. To enable Discount and Finance House of India Ltd. (DFHI), to deal in Government securities, the Reserve Bank of India provides necessary refinance.

The institutional infrastructure in government securities has been strengthened with the system of Primary Dealers (PDs) announced in March 1995 and that of Satellite Dealers (SDs) in December 1996.

Similarly, Securities Trading Corporation of India was established in 1994, to provide better market and liquidity for dated securities, and to hold short term money market assets like treasury bills. The National Stock Exchange (NSE), has an exclusive trading floor for transparent and screen based trading in all types of debt instruments

Regulation of Non-Banking Financial Companies

RBI Act was amended in 1997 to bring the NBFCs under its regulatory framework. A NBFC is a company registered under Companies Act, 1956 and is involved in making loans and advances, acquisition of shares, stocks, bonds, securities issued by government etc. They are similar to banks but are different from the latter as they cannot accept demand deposits and cannot issue cheques. They have to be registered with RBI to operate within India. There are a host of regulations which NBFCs have to follow to smoothly operate within India like accept deposit for a minimum period, cannot accept interest rate beyond the prescribed rate given by RBI.

Money Market Mutual Funds:

In 1992 setting up of Money Market Mutual Funds was announced to bring it within in the reach of individuals. These funds have been introduced by financial institutions and banks.

With these reforms the money market is becoming vibrant. There is further scope of introducing new market players and extending refinance from Reserve Bank of India.

Narasimham Committee has also proposed that well managed non-banking financial intermediates and merchant bank should also be allowed to operate in the money market. As and when implemented this will widen the scope of money market.

Permission to Foreign Institutional Investors (FII):

FII’s are allowed to operate in all dated government securities. The policy for 1998-99 had allowed them to buy treasury Bills’ within approved debt ceiling.

Institutional Development:

The post reforms period saw significant institutional development and procedural reforms aimed at developing a strong secondary market in government securities.

Setting up Discount and Finance House of India

Discount and Finance House of India was set up in 1988 to impart more liquidity and also further develop the secondary market instruments. However, maturities of existing instruments like CDs and CPs were gradually shortened to encourage wider participation. Likewise ad hoc treasury bills were abolished in 1997 to stop automatic monetisation of fiscal deficit.

Reintroduction of 182 days treasury bills:

The 182 days bills, which were discontinued in 1992, have been reintroduced from 1998-99. Now Indian money market has 14 days, 91 days, 182 days and 364 days treasury bills.

Demand for Treasury bill is no longer exclusively linked with statutory liquidity rates considerations. The secondary market transactions aiming at effective management of short term liquidity are on the increase.