The following are the accounting entries passed in the books of lessee:

- When the Royalty is Less than Minimum Rent and the Minimum Rent Account is not Maintained

- When the Royalty is Less than Minimum Rent and the Minimum Rent Account is Maintained

- When Royalties are more than Minimum Rent

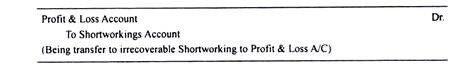

- When Short Working cannot be Recouped in Future

illustration:

N.B. The excess of Minimum Rent over actual Royalty is termed as Short workings. Here, the Lessee has a right to recover the Short workings over the first three years only. Therefore, in the year 2004. Lessee could recover Rs 4,000 out of the Royalty; the balance of Short workings Account amounting to Rs 4,500 (Rs. 6,500 + 2,000 = 8,500 – 4,000 = 4,500) written off to Profit & Loss Account, as the amount is no longer recoverable.

Entries for 2004 and 2005 are the same, as done. The reason is that in 2004 and 2005 the amounts of Royalties are more than the Minimum Rent. Therefore, Minimum Rent will not be opened.