Commercial banks are the most important components of the whole banking system.

A commercial bank is a profit-based financial institution that grants loans, accepts deposits, and offers other financial services, such as overdraft facilities and electronic transfer of funds.

According to Culbertson,

“Commercial Banks are the institutions that make short make short term bans to business and in the process create money.”

In other words, commercial banks are financial institutions that accept demand deposits from the general public, transfer funds from the bank to another, and earn profit.

Commercial banks play a significant role in fulfilling the short-term and medium- term financial requirements of industries. They do not provide, long-term credit, so that liquidity of assets should be maintained. The funds of commercial banks belong to the general public and are withdrawn at a short notice; therefore, commercial banks prefers to provide credit for a short period of time backed by tangible and easily marketable securities. Commercial banks, while providing loans to businesses, consider various factors, such as nature and size of business, financial status and profitability of the business, and its ability to repay loans.

Classification of Commercial banks

Commercial banks are of three types, which are as follows:

- Public Sector Banks

Refer to a type of commercial banks that are nationalized by the government of a country. In public sector banks, the major stake is held by the government. In India, public sector banks operate under the guidelines of Reserve Bank of India (RBI), which is the central bank. Some of the Indian public sector banks are State Bank of India (SBI), Corporation Bank, Bank of Baroda, Dena Bank, and Punjab National Bank.

- Private Sector Banks

Refer to a kind of commercial banks in which major part of share capital is held by private businesses and individuals. These banks are registered as companies with limited liability. Some of the Indian private sector banks are Vysya Bank, Industrial Credit and Investment Corporation of India (ICICI) Bank, and Housing Development Finance Corporation (HDFC) Bank.

- Foreign Banks

Refer to commercial banks that are headquartered in a foreign country, but operate branches in different countries. Some of the foreign banks operating in India are Hong Kong and Shanghai Banking Corporation (HSBC), Citibank, American Express Bank, Standard & Chartered Bank, and Grindlay’s Bank. In India, since financial reforms of 1991, there is a rapid increase in the number of foreign banks. Commercial banks mark significant importance in the economic development of a country as well as serving the financial requirements of the general public.

Primary Functions of Commercial Banks:

- Accepting Deposits from the public in savings account, current account, fixed deposits, recurring deposits, deposits from NRIs.

- Lending money to the public for their various purposes like personal loans, housing loans, vehicular loans, etc.

- Providing overdraft facility to the credit card holders and under any schemes by the government like in Pradhan Mantri Jan Dhan Yojana Scheme.

Secondary Functions or Para banking Activities of the Commercial Banks:

- Issue debit, credit and prepaid cards.

- Issue Letter of Credit and Bank Guarantee.

- Collect amounts through cheques and other instruments.

- Sale and purchase of shares and debentures.

- Act as investment bank for Initial Public Offering (IPO) by a private company.

- Help in anti-money laundering through KYC process.

- Become an intermediary between its customers and other institutions, like payment of insurance premium, payment of various bills, direct benefit transfer (DBT) scheme of government, etc.

- Provide facilities such as Electronic Clearing Service, transfer of funds domestically and internationally, locker facilities, foreign exchange, etc.

With the advances in technology, the commercial banks are also making advancement and providing the citizens of India with the best facilities and they are also easing the lives of people by providing many good facilities.

2019 recent news:

In August, 2019 Jana Small Finance Bank Ltd, which commenced banking operations in March 2018, has got the status of a Scheduled Bank.

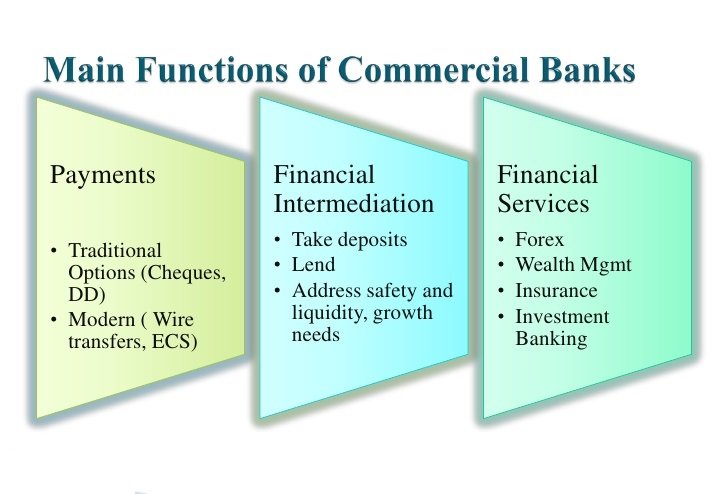

Functions of Commercial Banks

The two most distinctive features of a commercial bank are borrowing and lending, i.e. acceptance of deposits and lending of money to projects to earn Interest (profit). In short, banks borrow to lend. The rate of interest offered by the banks to depositors is called the borrowing rate while the rate at which banks lend out is called lending rate.

The difference between the rates is called ‘spread’ which is appropriated by the banks. Mind, all financial institutions are not commercial banks because only those which perform dual functions of (i) accepting deposits and (ii) giving loans are termed as commercial banks. For example, post offices are not bank because they do not give loans. Functions of commercial banks are classified in to two main categories: (A) Primary functions and (B) Secondary functions.

(A) Primary Functions:

- It accepts deposits:

A commercial bank accepts deposits in the form of current, savings and fixed deposits. It collects the surplus balances of the Individuals, firms and finances the temporary needs of commercial transactions. The first task is, therefore, the collection of the savings of the public. The bank does this by accepting deposits from its customers. Deposits are the lifeline of banks.

Deposits are of three types as under:

(i) Current account deposits:

Such deposits are payable on demand and are, therefore, called demand deposits. These can be withdrawn by the depositors any number of times depending upon the balance in the account. The bank does not pay any Interest on these deposits but provides cheque facilities. These accounts are generally maintained by businessmen and Industrialists who receive and make business payments of large amounts through cheques.

(ii) Fixed deposits (Time deposits):

Fixed deposits have a fixed period of maturity and are referred to as time deposits. These are deposits for a fixed term, i.e., period of time ranging from a few days to a few years. These are neither payable on demand nor they enjoy cheque facilities.

They can be withdrawn only after the maturity of the specified fixed period. They carry higher rate of interest. They are not treated as a part of money supply Recurring deposit in which a regular deposit of an agreed sum is made is also a variant of fixed deposits.

(iii) Savings account deposits:

These are deposits whose main objective is to save. Savings account is most suitable for individual households. They combine the features of both current account and fixed deposits. They are payable on demand and also withdraw able by cheque. But bank gives this facility with some restrictions, e.g., a bank may allow four or five cheques in a month. Interest paid on savings account deposits in lesser than that of fixed deposit.

2. It gives loans and advances:

The second major function of a commercial bank is to give loans and advances particularly to businessmen and entrepreneurs and thereby earn interest. This is, in fact, the main source of income of the bank. A bank keeps a certain portion of the deposits with itself as reserve and gives (lends) the balance to the borrowers as loans and advances in the form of cash credit, demand loans, short-run loans, overdraft as explained under.

(i) Cash Credit:

An eligible borrower is first sanctioned a credit limit and within that limit he is allowed to withdraw a certain amount on a given security. The withdrawing power depends upon the borrower’s current assets, the stock statement of which is submitted by him to the bank as the basis of security. Interest is charged by the bank on the drawn or utilised portion of credit (loan).

(ii) Demand Loans:

A loan which can be recalled on demand is called demand loan. There is no stated maturity. The entire loan amount is paid in lump sum by crediting it to the loan account of the borrower. Those like security brokers whose credit needs fluctuate generally, take such loans on personal security and financial assets.

(iii) Short-term Loans:

Short-term loans are given against some security as personal loans to finance working capital or as priority sector advances. The entire amount is repaid either in one instalment or in a number of instalments over the period of loan.

Investment:

Commercial banks invest their surplus fund in 3 types of securities:

(i) Government securities, (ii) Other approved securities and (iii) Other securities. Banks earn interest on these securities.

(B) Secondary Functions:

Apart from the above-mentioned two primary (major) functions, commercial banks perform the following secondary functions also.

- Discounting bills of exchange or bundles:

A bill of exchange represents a promise to pay a fixed amount of money at a specific point of time in future. It can also be encashed earlier through discounting process of a commercial bank. Alternatively, a bill of exchange is a document acknowledging an amount of money owed in consideration of goods received. It is a paper asset signed by the debtor and the creditor for a fixed amount payable on a fixed date. It works like this.

Suppose, A buys goods from B, he may not pay B immediately but instead give B a bill of exchange stating the amount of money owed and the time when A will settle the debt. Suppose, B wants the money immediately, he will present the bill of exchange (Hundi) to the bank for discounting. The bank will deduct the commission and pay to B the present value of the bill. When the bill matures after specified period, the bank will get payment from A.

- Overdraft facility:

An overdraft is an advance given by allowing a customer keeping current account to overdraw his current account up to an agreed limit. It is a facility to a depositor for overdrawing the amount than the balance amount in his account.

In other words, depositors of current account make arrangement with the banks that in case a cheque has been drawn by them which are not covered by the deposit, then the bank should grant overdraft and honour the cheque. The security for overdraft is generally financial assets like shares, debentures, life insurance policies of the account holder, etc.

- Agency functions of the bank:

The bank acts as an agent of its customers and gets commission for performing agency functions as under:

(i) Transfer of funds:

It provides facility for cheap and easy remittance of funds from place-to-place through demand drafts, mail transfers, telegraphic transfers, etc.

(ii) Collection of funds:

It collects funds through cheques, bills, bundles and demand drafts on behalf of its customers.

(iii) Payments of various items:

It makes payment of taxes. Insurance premium, bills, etc. as per the directions of its customers.

(iv) Purchase and sale of shares and securities:

It buys sells and keeps in safe custody securities and shares on behalf of its customers.

(v) Collection of dividends, interest on shares and debentures is made on behalf of its customers.

(iv) Acts as Trustee and Executor of property of its customers on advice of its customers.

(vii) Letters of References:

It gives information about economic position of its customers to traders and provides similar information about other traders to its customers.

- Performing general utility services:

The banks provide many general utility services, some of which are as under:

(i) Traveller’s cheques .The banks issue traveler’s cheques and gift cheques.

(ii) Locker facility. The customers can keep their ornaments and important documents in lockers for safe custody.

(iii) Underwriting securities issued by government, public or private bodies.

(iv) Purchase and sale of foreign exchange (currency).

One thought on “Commercial Banks Meaning and Functions”