Mutual Funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds aim to achieve specific investment objectives, such as growth, income, or preservation of capital. Each investor in a mutual fund owns shares, which represent a portion of the holdings of the fund. The value of these shares fluctuates with the market value of the fund’s underlying assets. Mutual funds offer individual investors access to diversified, professionally managed portfolios at a relatively low cost. They are suitable for a wide range of investment strategies and risk tolerance levels, making them a popular choice for individual investors looking to build and manage their wealth.

Balancing Mutual Funds:

-

Review Your Investment Goals:

Begin by revisiting your financial goals, which could range from saving for retirement, a down payment on a home, or funding education. Your goals’ time frames and the risk you’re willing to take on are critical in determining how your portfolio should be balanced.

-

Assess Your Current Portfolio:

Evaluate the current composition of your mutual fund investments. Look at the distribution across different asset classes (stocks, bonds, etc.), sectors, and geographical regions. This assessment will highlight areas of overconcentration or underexposure.

-

Check Performance against Benchmarks:

Compare the performance of your mutual funds against relevant benchmarks and peer funds. This can help identify underperforming funds that may need to be replaced or rebalanced.

-

Realign According to Risk Tolerance:

As you age or as your financial situation changes, your appetite for risk may change. Younger investors might lean towards stock-heavy portfolios for growth, while those closer to retirement may prefer bonds for income and stability. Rebalance your portfolio to match your current risk tolerance.

-

Rebalance to Maintain Asset Allocation:

If certain investments have performed well, they might now represent a larger portion of your portfolio than intended, increasing your risk. Sell off portions of overperforming investments and buy more of underperforming ones to maintain your desired asset allocation.

-

Consider Tax Implications:

Be mindful of the tax consequences of selling investments. In taxable accounts, selling investments that have appreciated significantly might lead to capital gains taxes. Consider strategies like tax-loss harvesting to offset gains.

-

Automate Rebalancing:

Some mutual funds and investment platforms offer automatic rebalancing services, adjusting your portfolio at regular intervals or when it deviates from your target allocation by a certain percentage.

-

Regular Review and Adjustment:

Balancing is not a one-time task. Regularly review your portfolio—at least annually—to ensure it remains aligned with your investment goals and market conditions.

Reasons of Balancing Mutual Funds:

-

Maintaining Risk Tolerance:

Over time, the performance of different asset classes can cause your portfolio to drift from its original asset allocation, potentially exposing you to more risk than you initially intended. Rebalancing helps keep your portfolio aligned with your risk tolerance and investment goals.

-

Capitalizing on Buy Low and Sell High:

Rebalancing allows investors to systematically sell assets that have increased in value and buy more of the assets that have decreased in value. This disciplined approach encourages selling high and buying low, which can enhance long-term returns.

-

Adapting to Life Changes:

As investors move through different stages of life, their financial goals, investment time horizon, and risk tolerance may change. Regularly rebalancing ensures that their investment strategy remains aligned with these changing personal circumstances.

-

Responding to Market Fluctuations:

The financial markets are dynamic, with various sectors and asset classes outperforming others in different market conditions. Rebalancing allows investors to adjust their portfolios in response to these market movements, potentially capturing growth opportunities in underweighted asset classes.

-

Diversification Maintenance:

Diversification helps reduce the risk of significant losses by spreading investments across various asset classes. As the market values of investments change, rebalancing is necessary to maintain the intended level of diversification, thereby potentially reducing volatility and improving returns.

-

Disciplined Investing Approach:

Rebalancing enforces a disciplined approach to investing, requiring investors to periodically review and adjust their portfolios. This can help investors stay focused on their long-term investment goals and avoid making impulsive decisions based on short-term market movements.

-

Achieving Long-Term Investment Goals:

By keeping the portfolio aligned with the investor’s financial goals and risk profile, rebalancing plays a crucial role in helping investors stay on track to achieve their long-term objectives, whether it’s saving for retirement, buying a home, or funding education.

Fund’s CAGR:

Compound Annual Growth Rate (CAGR) is a useful measure to evaluate the performance of various investments, including mutual funds, over time. CAGR represents the mean annual growth rate of an investment over a specified time period longer than one year, assuming the profits were reinvested at the end of each year of the investment’s lifespan. It provides a smoothed annual rate that flattens out the volatility and fluctuations that can occur in the performance of the investment from year to year.

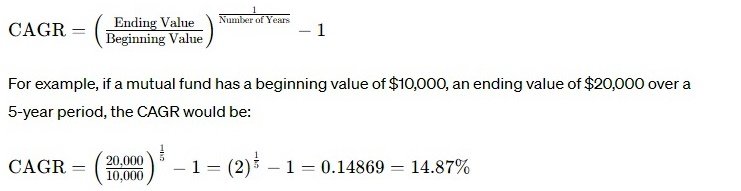

CAGR is calculated using the following formula:

This means the fund grew at an average annual rate of 14.87% over the 5-year period.

CAGR is particularly useful for comparing the performance of different investments on a like-for-like basis. It simplifies the comparison by providing a single growth rate number that accounts for the compounding effect of returns over time. However, it’s important to remember that CAGR does not reflect investment risk. Two investments could have the same CAGR but vastly different levels of volatility and risk. Investors should consider other metrics and factors, including risk tolerance, investment objectives, and market conditions, alongside CAGR when making investment decisions.

-

SIP (Systematic Investment Plan)

Systematic Investment Plan (SIP) is a method of investing in mutual funds. It allows investors to invest a fixed amount of money regularly, typically monthly or quarterly, into a chosen mutual fund. SIPs are a disciplined way to invest, enabling investors to buy units over time, rather than investing a lump sum. This approach leverages the benefit of rupee cost averaging, where more units are purchased when prices are low and fewer units when prices are high, potentially reducing the average cost per unit over time.

-

SWP (Systematic Withdrawal Plan)

Systematic Withdrawal Plan (SWP) is essentially the opposite of a SIP. It allows investors to withdraw a fixed amount of money at regular intervals from their mutual fund investments. This can provide a regular income stream and is particularly useful for retirees or those needing periodic payouts to meet their expenses. The withdrawal frequency can be customized according to the investor’s needs, such as monthly, quarterly, etc.

-

STP (Systematic Transfer Plan)

Systematic Transfer Plan (STP) is a strategy that allows investors to transfer a fixed amount of money from one mutual fund scheme to another within the same fund family at regular intervals. STPs are often used to gradually move money from debt funds to equity funds (or vice versa), allowing investors to adjust their portfolio’s risk and return characteristics over time or take advantage of market conditions.

Index Funds

Index funds are a type of mutual fund designed to replicate and track the components of a market index, such as the S&P 500 or the Nifty 50. The primary goal of an index fund is to provide broad market exposure, low portfolio turnover, and lower operating expenses. Unlike actively managed funds, where fund managers make decisions on what securities to buy or sell, index funds passively follow the index, making changes only when the index itself changes. This passive management approach often results in lower fees for investors. Index funds are suitable for investors looking for a long-term, cost-effective investment strategy that mirrors overall market performance.

Index Funds Features:

-

Passive Management:

Unlike actively managed funds, where fund managers make decisions on buying and selling securities, index funds aim to replicate the performance of a specific market index. The fund’s portfolio mirrors the constituents of the index it tracks, with minimal buying and selling, which is often referred to as a passive management strategy.

-

Lower Costs:

Due to their passive management approach, index funds typically incur lower operating expenses compared to actively managed funds. They do not require a team of analysts or extensive research to select stocks, resulting in lower expense ratios for investors. This cost-efficiency is one of the major attractions of index funds.

- Diversification:

Index funds provide instant diversification by holding all or a representative sample of the securities in the index they track. This can spread out risk across a wide array of sectors and companies, which is beneficial for reducing the impact of poor performance by any single security on the overall investment.

- Transparency:

The holdings of an index fund mirror the constituents of its benchmark index, making the fund’s holdings highly transparent to investors. This allows investors to know exactly which assets they are invested in at any given time.

-

Market Exposure:

Index funds offer exposure to broad segments of the market or specific sectors, depending on the index they track. For instance, an index fund tracking the Nifty 50 provides exposure to the top 50 companies in the Indian stock market, representing various sectors.

-

Performance Predictability:

While individual stock performance can be unpredictable, index funds aim to match the performance of their benchmarks (before fees). This predictability is appealing to investors who wish to achieve returns that are closely aligned with market performance.

-

Ease of Investment:

Investing in index funds is straightforward, making them accessible to both novice and experienced investors. Many investors appreciate the simplicity of aligning their investment strategy with the broader market’s performance without the need to pick individual stocks.

-

Dividend Reinvestment:

Many index funds offer dividend reinvestment plans, allowing investors to automatically reinvest dividends paid out by the fund into additional shares. This can compound returns over time by taking advantage of the power of compounding.