There are two methods for entering hire purchase transactions in the books of the hire- purchaser. The first is to enter transactions like ordinary purchases with the difference that interest is to be provided. This method recognizes the fact that the intention of the parties is to complete the purchase and to pay all the instalments. Hence, on purchase of machinery, machinery is debited and the hire vendor is credited with the cash price. When payment is made, the hire vendor is debited. At the end of each financial year, interest is credited to the hire vendor and debited to Interest Account. Depreciation is charged in the ordinary manner.

illustration 1:

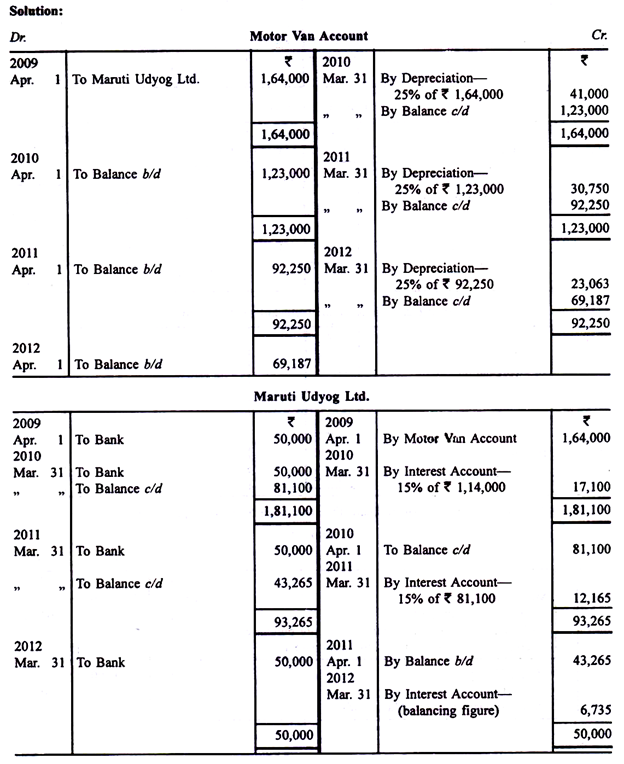

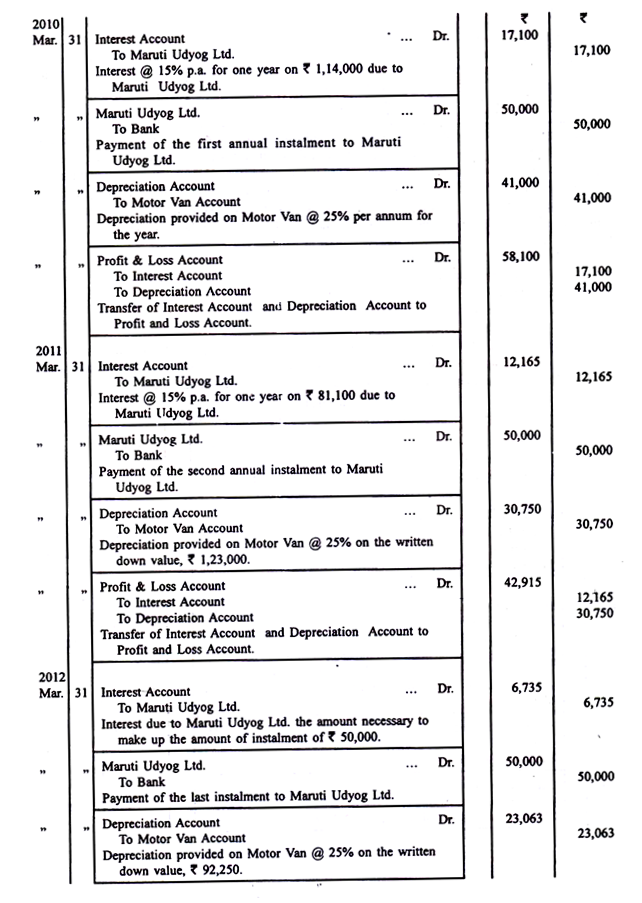

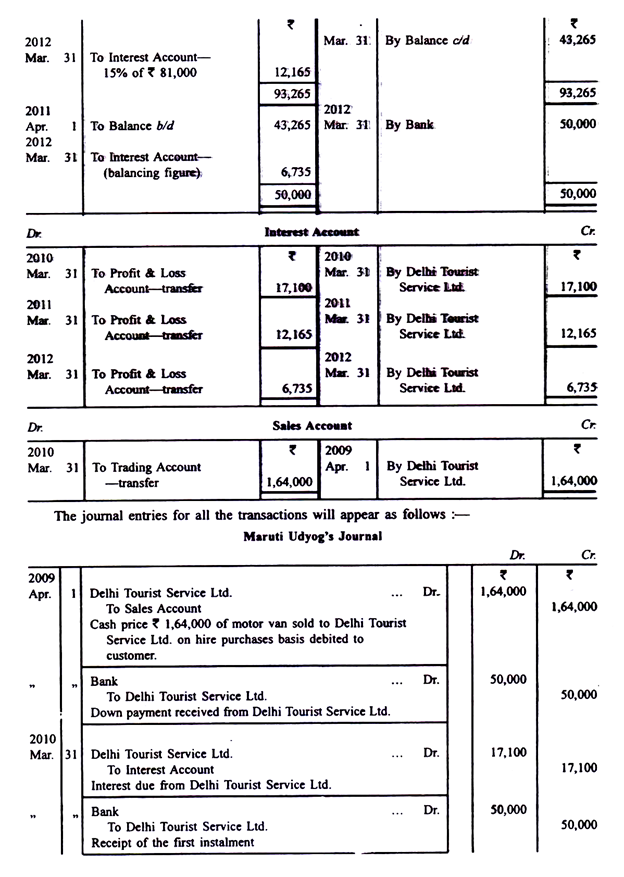

Delhi Tourist Service Ltd. purchased from Maruti Udyog Ltd. a motor van on 1st April, 2009 the cash price being Rs 1,64,000. The purchase was on hire purchase basis, Rs 50,000 being paid on the signing of the contract and, thereafter, Rs 50,000 being paid annually on 31st March, for three years, Interest was charged at 15% per annum. Depreciation was written off at the rate of 25 per cent per annum on the reducing instalment system. Delhi Tourist Service Ltd. closes its books every year on 31st March. Prepare the necessary ledger accounts in the books of Delhi Tourist Service Ltd.

The other method of passing entries in the books of the hire purchaser seeks to recognize the fact that no property passes to the hire-purchaser till the final payment is made. Hence, no entry is passed when the contract is signed.

Entries are made at the time of payment of each instalment. The interest included in the instalment is debited to the interest account; the remaining amount is debited to the asset. Thus, if a payment is made down, the entry is to debit the asset and credit Bank, there being no interest when payment is made on the signing of the contract.

When the next instalment is paid, the entries will be:

- Debit Asset Account

- Debit Interest Account

- Credit Hire Vendor; and

- Debit Hire Vendor Credit Bank.

Depreciation must be allowed on the basis of the full cash price. This is because the whole asset is being used and because ultimately the asset must be paid for wholly.

The journal entries for the illustration number 3 given above, under this method will be as under:

Entries in Interest Account, Depreciation Account and Profit & Loss Account will be the same as have been passed under the first method.

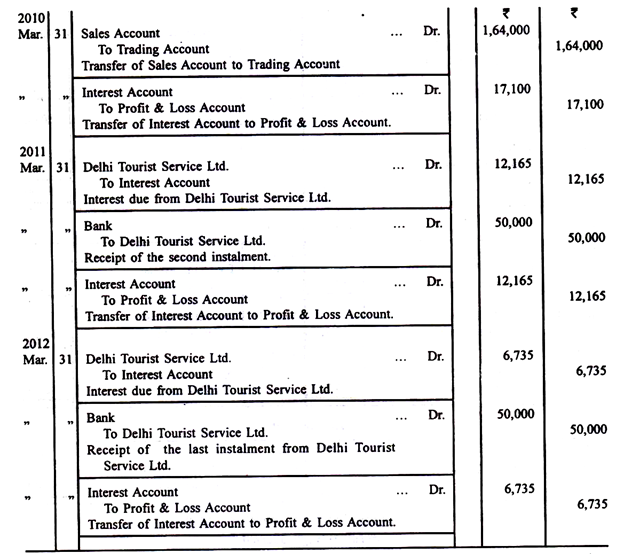

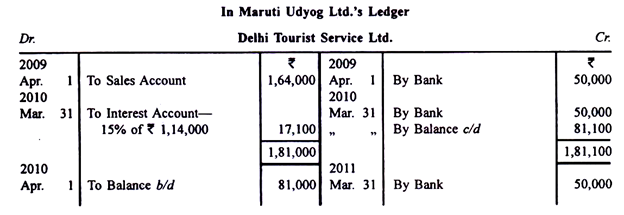

Books of Hire-Vendor

The hire-vendor treats the hire purchase sale like an ordinary sale. He debits the hire purchaser with the full cash price and credits the Sales Account. Interest is debited to the hire purchaser when instalments become due. Cash received is, of course, credited to the hire purchaser.

In the books of the hire-vendor, the accounts pertaining to the above illustration will be as follows:

illustration 2:

On 1st April, 2008, Ashok acquired machinery on hire purchase system from Modmac Ltd., agreeing to pay four annual instalments of Rs 60,000 each payable at the end of each year. There is no down payment. Interest is charged @ 20% per annum and is included in the annual instalments.

Because of financial difficulties, Ashok, after having paid the first and second instalments, could not pay the third yearly instalment due on 31st March, 2011, whereupon the hire vendor repossessed the machinery. Ashok provides depreciation on the Machinery @ 10% per annum according to the written down value method. He closes his books of account every year on 31st March. Show Machinery Account and the account of Modmac Ltd. for all the years in the books of Ashok. All workings should form part of your answer. [B.Com. (Hons.) Delhi, 1995 Modified]

One thought on “Accounting Records in the Books of Hire Purchaser and Vendor”