Returns to Scale refer to the change in output resulting from a proportional increase in all inputs in the production process, typically in the long run when all factors are variable. It describes how efficiently a firm can scale its operations.

Returns to Scale are of the following Three types

1. Increasing Returns to Scale

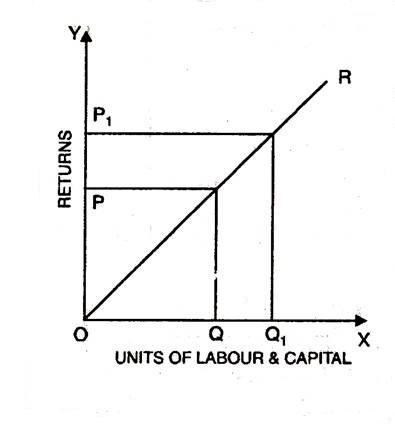

Increasing returns to scale or diminishing cost refers to a situation when all factors of production are increased, output increases at a higher rate. It means if all inputs are doubled, output will also increase at the faster rate than double. Hence, it is said to be increasing returns to scale. This increase is due to many reasons like division external economies of scale. Increasing returns to scale can be illustrated with the help of a diagram.

In figure, OX axis represents increase in labour and capital while OY axis shows increase in output. When labour and capital increases from Q to Q1, output also increases from P to P1 which is higher than the factors of production i.e. labour and capital.

2. Constant Returns to Scale

Constant returns to scale or constant cost refers to the production situation in which output increases exactly in the same proportion in which factors of production are increased. In simple terms, if factors of production are doubled output will also be doubled.

In this case internal and external economies are exactly equal to internal and external diseconomies. This situation arises when after reaching a certain level of production, economies of scale are balanced by diseconomies of scale. This is known as homogeneous production function. Cobb-Douglas linear homogenous production function is a good example of this kind. We see that increase in factors of production i.e. labour and capital are equal to the proportion of output increase. Therefore, the result is constant returns to scale.

3. Diminishing Returns to Scale

Diminishing returns or increasing costs refer to that production situation, where if all the factors of production are increased in a given proportion, output increases in a smaller proportion. It means, if inputs are doubled, output will be less than doubled. If 20 percent increase in labour and capital is followed by 10 percent increase in output, then it is an instance of diminishing returns to scale.

The main cause of the operation of diminishing returns to scale is that internal and external economies are less than internal and external diseconomies.

Uses of Return to Scale in Business:

- Production Planning

Returns to Scale help businesses plan production by understanding how output changes when inputs are scaled up or down. This allows firms to determine whether increasing all inputs will lead to proportionate, more than proportionate, or less than proportionate increases in output.

- Cost Management

By identifying the stage of returns to scale (increasing, constant, or decreasing), businesses can optimize their input mix to minimize costs. For example, firms experiencing increasing returns to scale can benefit from economies of scale, reducing average costs as production increases.

-

Capacity Expansion

Understanding returns to scale guides businesses in determining the right time to expand operations. Firms experiencing increasing returns to scale may invest in expanding capacity, knowing that it will lead to higher output at a lower per-unit cost.

-

Investment Decisions

Returns to Scale help firms assess whether investing in more resources (labor, capital) will be profitable. If a company is in a phase of increasing returns to scale, further investment in inputs can lead to higher profitability.

-

Market Competitiveness

Firms with increasing returns to scale can produce goods at lower costs, giving them a competitive advantage. They can leverage lower production costs to reduce prices or increase market share.

-

Strategic Growth Planning

Businesses use returns to scale to formulate long-term growth strategies, deciding whether to scale up production or maintain current operations based on the cost-output relationship.