The Lessor is entitled to receive Royalty from the Lessee. Here royalty would be an income to the Lessor. The entries would therefore be the reverse of those made in the Lessee’s books.

However, it may be noted that in place of Short working Account, the Lessor maintains the Royalty Reserve or Royalty Suspense Account.

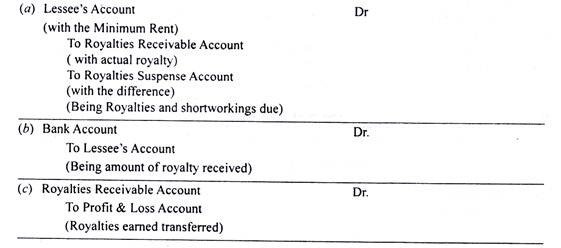

The following are the accounting entries in the books of lessor:

- When the Royalties are Less than Minimum Rent and Short Workings are Recoverable out of Future Years

- When the Royalties Earned Exceed the Minimum Rent and Short Workings are Recovered

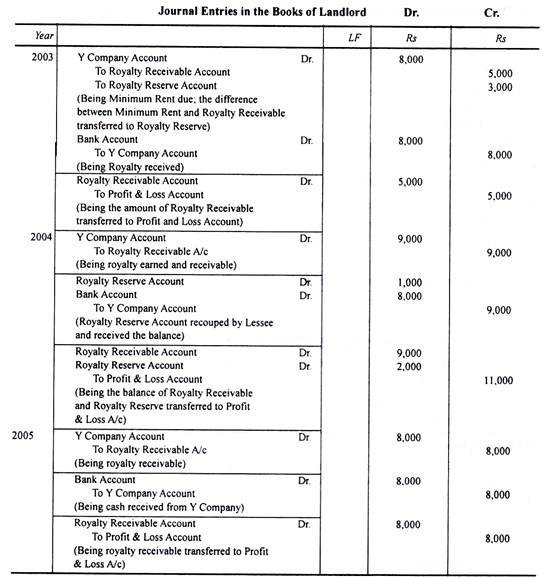

illustration 1:

Y Company is a lessee of a mine on a royalty or Re 1 per ton of coal raised with minimum re to R 8.000 per annum with power to recoup short workings during the first two years of the lease only.

The output for the first three years is:

Pass the necessary journal entries in the books of landlord.

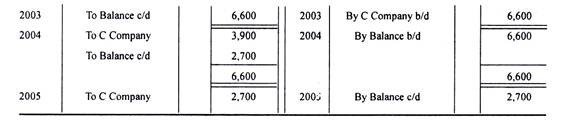

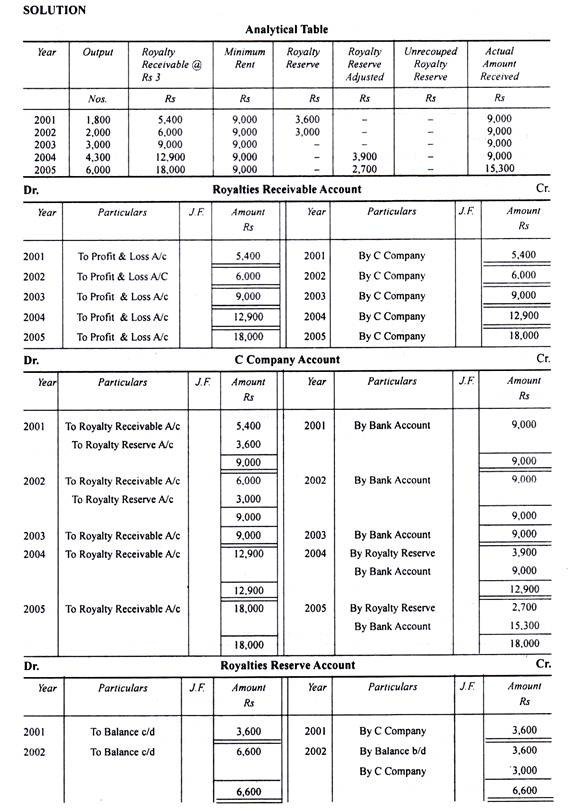

illustration 2:

illustration 2:

The copy write of a book was held by B Company.

C Company was allowed to publish the book on the following terms and conditions:

(a) Royalty payable is Rs 3 per book.

(b) The Minimum Royalty is fixed at Rs 9,000 p.a.

(c) The short workings can be recouped within first five years only.

The following are the details of the number of copies published by C Company:

You are required to prepare Journal entries and Ledger account to record the above transactions in the books of B Company.